Housing mortgage rates were expected to be slightly lower in 2025 for the housing market compared to 2024. While rates have been slightly down so far in 2025 compared to 2024, it hasn’t been significant. Inflation continues to be persistently high, the U.S. Federal Reserve hasn’t cut interest rates so far in 2025, which means home loan mortgage rates have remained high between 6.50 to 7.05 percent in 2025.

It’s not all doom and gloom. Many experts expect the mortgage rates in the housing market to drop toward the end of 2025 and lower in 2026. The Federal Reserve also might cut rates two times before the end of the year, according to experts.

This Moving Help® article will explore current mortgage rates, what experts are predicting for mortgage rates, the Federal Reserve and whether they’ll cut rates in 2025, the housing market trends, and some ways to figure out whether you should wait or buy a house.

As always, consult with your real estate and loan mortgage experts.

Current Mortgage Rates and Housing Market Overview

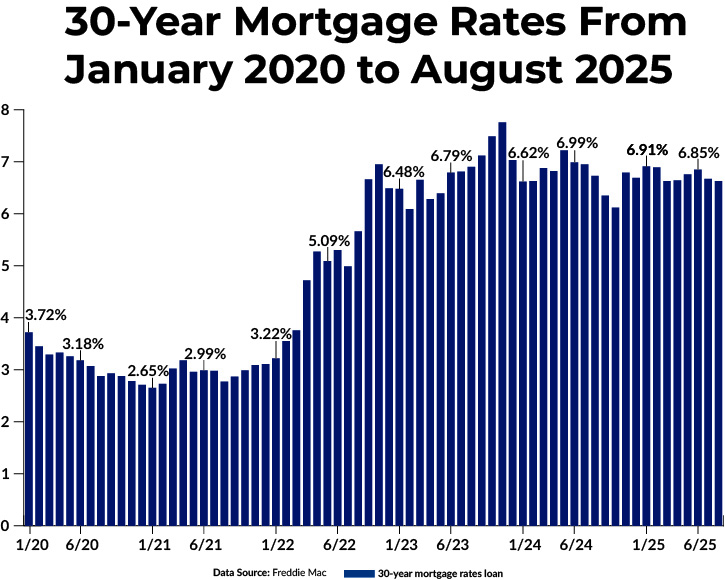

House mortgage rates continue to remain in the 6 to 7 percent range. They’ve ranged anywhere from approximately 6.50 percent to 7.05 percent in 2025, according to Freddie Mac. August 2025 has been quite good for mortgage rates as they’ve fallen to the lowest levels in nearly 11 months, according to Bankrate.

When the coronavirus pandemic happened, the U.S. Federal Reserve slashed interest rates to as low as 2 to 3 percent. Since 2022, housing mortgage rates have steadily climbed upward.

Why are the rates so high in 2025?

One reason they’re high is because of inflation. The inflation rate increased about 2.7 percent in June 2025 and could reach 3.0 percent by the end of 2025, which is higher than the Federal Reserve’s target inflation rate of 2 percent. Because of this, the Federal Reserve has held steady with interest rates.

Initially, many experts predicted in 2024 the Federal Reserve would cut rates up to four times in 2025. Before the end of 2024, that prediction was lowered to two cut rates. The Federal Reserve hasn’t cut rates once in 2025 yet.

Predictions for Housing Mortgage Rates

While current mortgage rates are still high for potential home buyers, buyers might see some relief later in 2025 and in 2026.

End of 2025 Forecast

Many experts expect the housing mortgage rates to drop a little bit by the end of 2025. The following experts expect the mortgage rate housing market to be at the end of the year:

- Fannie Mae: Average around 6.6 percent

- National Association of Realtors: Average 6.7 percent

- Mortgage Bankers Association: Stay above 6.7 percent

- National Association of Home Builders: Average 6.7 percent

- Realtor.com: Average 6.7 percent

- Wells Fargo: Average 6.67 percent

Outlook for 2026

Most experts also expect housing mortgage rates to drop in 2026 as well. Most expect inflation to cool off along with the Federal Reserve to continue to cut interest rates. This will help lower mortgage rates for the housing market.

The following predictions from the experts for 2026 include:

- Fannie Mae: 6.1 percent

- National Association of Home Builders: 6.3 percent

- National Association of Realtors: 6.0 percent

- Mortgage Bankers Association: 6.4 percent

- Wells Fargo: 6.51 percent

If you’re interested in getting a lower rate, so you can have a lower monthly payment, you might want to consider waiting based on these expert predictions.

U.S. Federal Reserve and Interest Rates

Heading into 2025, many experts expected the Federal Reserve to cut interest rates at least two times. The economy has been up and down, the labor market has been a bit weakened, and inflation has still been persistent.

Because of these factors, the Federal Reserve hasn’t slashed interest rates once so far in 2025.

Most experts still think the Federal Reserve will cut interest rates at least two times in 2025. If a cut does occur in 2025, it’ll most likely happen at the Federal Reserve’s September’s and December’s meetings.

While the Federal Reserve doesn’t set mortgage rates, mortgage lenders follow their lead.

If the Federal Reserve does cut rates, more potential homebuyers could get a loan and buy a home. Otherwise, if the rates stay the same, fewer buyers will be in the market to buy a house.

Housing Market Trends

Besides house mortgage rates, homes themselves have been trending upward. We’ll discuss how the rising housing prices and the U.S. housing shortage has been put a damper on potential buyers.

Rising Housing Prices

Housing prices rose in 2025. Housing prices will continue to rise into 2026. For example, the medium home-sale price in May 2025 in the United States was $422,800, which was an all-time high for May along with 23 consecutive months of year-over-year home-price increase, according to the National Association of Realtors.

U.S. Housing Shortage

The other main factor that’s causing home prices to rise is a housing shortage in the United States. The total housing inventory has increased from a 3.2 to 3.8 to a 4.6-month supply.

That number isn’t high enough, however.

A balanced housing market has a preferred 5- to 6-month supply, according to most experts. Anything less than four to six months is considered a seller’s market, and anything more than four to six months is considered a buyer’s market.

Additionally, many homebuyers bought a new home or refinanced their house during the pandemic to get super low interest rates.

This means many potential sellers chose to stay in their home rather than sell, so they didn’t have to give up their low mortgage rates. This component also has assisted in housing shortage.

Understanding the Housing Mortgage Rates

Usually, a normal house mortgage rate would be between 4 to 5 percent, which would help the house market and get back to the 2014-2019 levels. Many experts believe it’ll be a while before the housing market reaches that level again.

If you’re wondering whether mortgage rates will ever be 3 percent again, the answer is likely no. An economic crisis, like the previous pandemic, would need to happen to reach those historic levels.

Just keep in mind, current interest rates aren’t the highest they’ve ever been in the United States. The 1980s holds that spot for the highest interest rates — which peaked at 18.63 percent in October 1981.

Making a Personal Decision: To Buy or Not to Buy

Whether to buy now or to wait to see whether the current house mortgage rates will get lower in the future is a personal decision. If you found the perfect house and can get a decent monthly payment, you might want to consider buying a house.

If you don’t want to buy a house now, you can focus on saving money, saving for a larger down payment, which would help lower monthly payment, and improve your credit score. These factors will help you when buying a house at the right time for you.

As always, consult with your real estate experts, mortgage lender experts, and anyone else who’ll assist you in your homebuying journey. You can use online mortgage calculators to assist as well.

Housing Mortgage Rates Remain High in 2025

Mortgage rates in the housing market stayed higher than most experts expected in 2025. Potential homebuyers could see some relief at the end of 2025 and in 2026 with interest rates likely to decrease.

The Federal Reserve could help lower interest rates by cutting rates at the group’s September and December meetings. Housing prices have increased along with a housing shortage that has hurt potential homebuyers from finding their dream home.

Finally, buying a house is a personal decision for every individual or family. As always, consult with your real estate and loan mortgage experts first.