Rent prices are rising across the United States, but with inflation staying high, home mortgage rates remain higher compared to previous years. You may wonder whether is it better to rent or buy a house in 2024?

The answer is a little bit more complicated than just mortgage rates. It depends on your financial wellbeing, the ability to afford a down payment, your job security, whether you want to stay in one place for a while, make repairs, and other reasons.

Moving Help® will provide you with misconceptions, pros and cons for owning a house or renting, mortgage rates, and better clarity on how to assist you with a decision.

Common Misconceptions When You Rent or Buy a House

First, before we can begin the pros and cons of renting and owning a house, we have to discuss the common misconceptions with them.

Renting Misconceptions

It’s long been said renting is just throwing your money away. That you’re wasting your time renting and giving free money to your landlord. This isn’t true, especially in 2024. While you’re not building any home equity, renting does provide more flexibility.

Renting can be less expensive than owning a home, which is another positive. Some people might not want the responsibilities of home ownership. Just know, if you want to rent, it’s not entirely a waste of time or money.

Home Ownership Misconceptions

While owning a house is great, you’ll need to ensure you can afford more than just your monthly mortgage. You need to account for additional costs such as taxes, fees, insurance, and potentially HOA fees each month. Many people see owning a house as part of the “American Dream.”

Homeownership provides positives that renting can’t offer. You have more privacy, are less likely to have noisy neighbors, can build home equity, and have the freedom to paint walls and hang pictures as you wish. Additionally, you don’t have a landlord dictating what you can’t and can do.

Understanding the Pros and Cons

Homeownership has pros and cons, and renting has pros and cons associated with them. We’ll go step-by-step explaining each one for both sides.

Pros of Buying a House

One of the first pros to buying a house is you get to build equity. The longer you own your home, the more home equity you can create because the less you’ll owe to your lender.

Sometimes when you build enough equity, you can take out a home equity loan. You also can use a tax deduction when it comes to owning your home.

The next part about buying a house is stability and permanence. When you buy a house, you’ll get to stay there permanently. You won’t have to worry about moving in a year because a landlord doesn’t want to renew your lease or sell their property.

The other part is stability. You don’t need to figure out whether you want to move year after year. Your mortgage won’t increase each year, unlike rent where a landlord can increase your rent each year when you renew your lease.

While it’s not a guarantee because of several factors that you can and can’t control, typically your home will gain appreciation over time. Meaning your home will be worth more after so many years compared to when you first bought your home.

Cons of Buying a House

The most obvious cost of buying a house is high, upfront costs. When you rent, you typically must pay a security deposit and the first month’s rent prior to moving into your rental unit.

You need plenty of money upfront for a house. You’ll pay for a down payment, closing costs, a home inspection, appraisal fees, homeowners insurance, and moving costs. Then you must pay for ongoing costs as you live in your new home.

When you own a house, you’re responsible for maintenance fees and upkeeping responsibilities. Long are the days where you call your landlord or maintenance team to fix the A/C that broke in your apartment. You’re responsible for plumbing, heating, A/C, and other issues along with paying for those costs yourself.

You can buy a house and stay there for as long as you want. Unfortunately, it’s not worth your time or money to move one year after you bought a house. You don’t have the flexibility like renting where you can pick and choose where you want to live if you don’t like your previous location. Once you find a home to buy, you must be sure you’ll want to live there for at least three to five years.

Pros of Renting

The first advantage to renting an apartment unit or a rental home is you’re not stuck there permanently. You can leave and move to a new home once your lease ends. If it’s truly awful, you can break your lease and find a new place. This flexibility is great whether you’re unsure where you want to live or move multiple times because of your job.

Renting also has much lower upfront costs compared to buying a house. You typically pay for an application fee, a cleaning deposit or a security deposit (the amount varies by state and landlord owners), and maybe the first month’s rent. This is significantly less money than buying a house.

These costs make it more manageable to know what you expect to pay month after month while renting.

Finally, the best part about renting is minimal responsibility for maintenance. If your A/C breaks or your toilet gets clogged, all you have to do is submit a maintenance request online or call your landlord. Your landlord is responsible for making sure the maintenance request gets fixed in a timely manner along with any costs associated with the repairs.

Cons of Renting

Just like owning a house, renting comes with its own cons. The first distinct con is the lack of equity building. You pay a landlord for your rental unit, so you don’t build equity.

Plus, you have limited control over the property you rent. You can’t paint walls, renovate the kitchen, or knock down walls without permission from your landlord first. You also could have quiet hours or limit the number of guests who can stay over and for how long they can stay there.

The final con about renting an apartment or a home is rent increases. A landlord can’t increase your rent in the middle of your leasing term, but the landlord can choose to increase your rent when you try to renew your lease agreement.

Unless you live in a rent-controlled area, your rent could increase every single time you renew your lease.

Mortgage Rates in 2024: A Snapshot

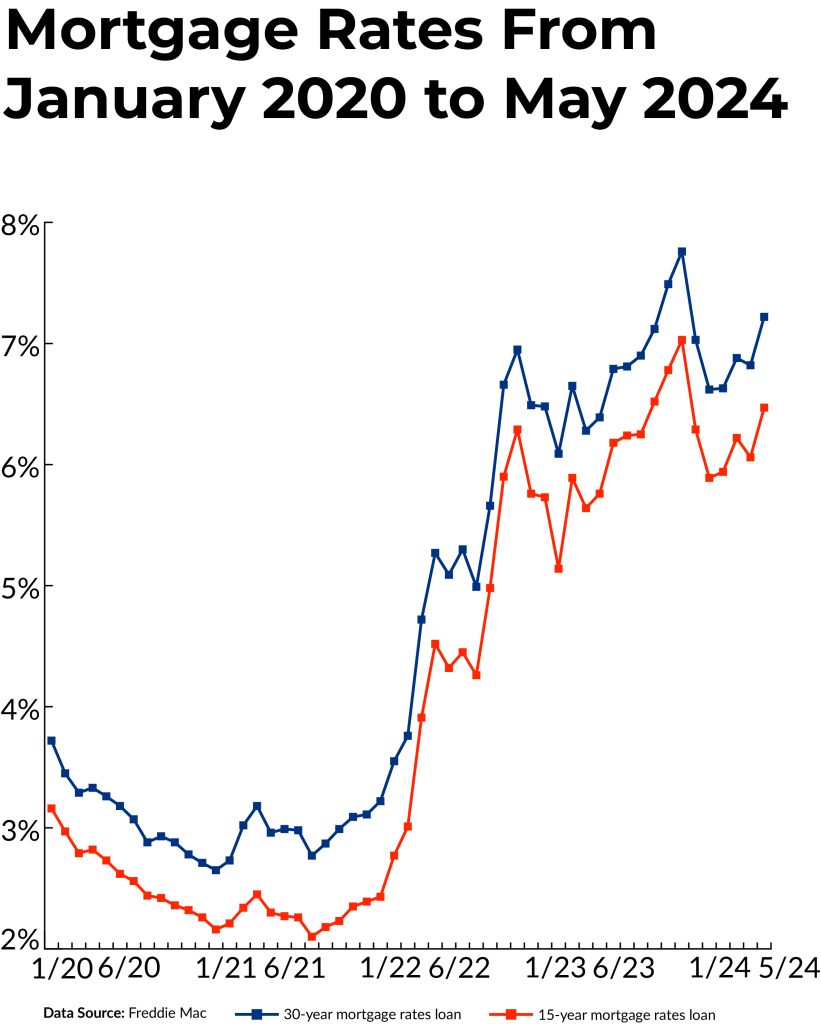

Home mortgage rates in 2024 have hovered around from 6 to 7 percent so far in 2024. Many people believe that’s way too high, but that’s not always been the case.

Just four years ago when in the coronavirus pandemic spread across the world, the United States lowered home mortgage rates anywhere from 2 to 3 percent. Many people got a great mortgage rate or got a great mortgage rate when they refinanced their home.

Of course, 6 to 7 percent nowadays will seem extremely higher compared to 2 to 3 percent.

Freddie Mac has been tracking mortgage rates since 1971. Since 1971, the highest mortgage rates have been in the 1980s. The early to mid 1980s saw mortgage rates from 12 percent to 18 percent.

While it’s been some time for interest rates to hover around 6 to 7 percent, it could be much worse.

Factors in Influencing the Decision

You’ve learned the pros and cons of renting an apartment, the pros and cons of buying a house, and a snapshot of mortgage rates. Beyond these reasons, other factors can influence your decision such as:

- Financial considerations

- Market conditions

- Personal preferences and lifestyle factors

- Long-term goals and plans

- Family situation and future needs

- Career stability and job prospects

Financial Considerations

You must consider your ability to afford a home or a rental unit better. You don’t want to go in debt and lose your home or rental unit. You’ll need to calculate the costs for homeownership vs. the costs for renting. You need to decide whether you have earned enough money to meet your goals.

Market Conditions

Market conditions also will factor into your decisions. The increase of housing prices and rental rates might make you adjust your budget.

With interest rates being higher compared to several years ago, you might decide to hold off buying a house right now.

Depending on where you live, you might stay at your rental place because they don’t raise your rent every year.

You also might decide to move more frequently because you want to find a less expensive place to live.

Personal Preferences and Lifestyle Factors

Your personal preferences and lifestyle factors also will play a role in deciding to rent or buy a house. If you don’t like to stay in one place for long, buying a house might not be the best option for you.

If you found your dream city where you could live for a long time, you could consider buying a home, especially if you found an area in the city where you enjoy spending time.

If you travel months away from your home, you might consider renting, so you can sublet your apartment. If you want to get married to start a family — children or pets — you might want some roots settled down first.

Long-Term Goals and Plans

Your long-term goals and plans will have a huge influence in deciding between renting or buying a house. If you plan on living in one location for a long time, you might consider renting first to find what area you like first before buying a house. If your long-term plans include you moving to a new state, you might want to consider just renting in the meantime.

Family Situation and Future Needs

Future needs might require you to rent in the short term, or your future might need you to stay put in the long term and buying a house might make the most sense.

You might begin starting a family or start growing your family, which means you’ll need enough space for your family. You might decide to go from a one-bedroom or two-bedroom apartment to a three-bedroom home.

Career Stability and Job Prospects

Before you begin the process of answering the question “is it better to rent or buy a house,” a good place to start is your job prospects and career stability. If you have a stable career, you’ll be able to earn a consistent income, which could lead you to buying a house.

Making the Right Choice

Everyone must evaluate their individual circumstances to determine whether should I rent or buy a house. You should weigh the pros and cons of renting and buying a home. You also should seek expert advice and guidance from the experts in the industry.

This includes your real estate agent, home inspector, mortgage broker, and others.

Should I Rent or Buy a House in 2024?

Is it better to rent or buy a house? This isn’t a simple question as to whether you have enough money. You might have more than enough money to buy a house in 2024, but just because you have enough money doesn’t mean owning a house is the right fit for you.

You must weigh the pros and cons of renting an apartment or buying a house. You need to consider mortgage rates, learning misconceptions, and consider other factors that’ll influence your personal decision.

One factor you can count on is moving labor from the Moving Help Marketplace to help you with your move. Moving Help can assist with loading, unloading, packing, gun safe moving, U-Box storage containers, and more.

Frequently Asked Questions for Is It Better to Rent or Buy a House

Q: Is owning a house better than renting?

A: While owning a house is typically better in the long run, it depends on your finances, lifestyle, and personal goals. If you need more flexibility, renting might be better, but if you’re financially stable and market conditions are favorable, owning a house choice be a better choice.

Q: Is it smarter to rent or to buy?

A: It depends on your situation. If you like living in different places, renting might be a better choice. If you want to set down some roots and stay put in one place, buying a house might be smarter, especially if you’re financially stable.

Q: Is it ever a good idea to rent?

A: Yes, renting can be a good idea if you’re unsure where you want to live, don’t have enough money to buy a house, or prefer the convenience of not worrying about maintenance problems.

Q: What are the cons of renting?

A: The cons of renting include not building equity, having limited control over home changes, potential rent increases from your landlord, and following rules about pets and guests.

Q: Is renting really throwing money away?

A: No, renting isn’t throwing money away. If your situation requires flexibility or if you’re not yet financially ready to buy a house, renting can be a smart choice.

Q: What age is the best to buy a house?

A: The best age to buy a house depends on your personal situation, including financial stability and long-term goals. For some, buying in their 20s might be ideal, but for others, it could be best to wait until their 30s or 40s.